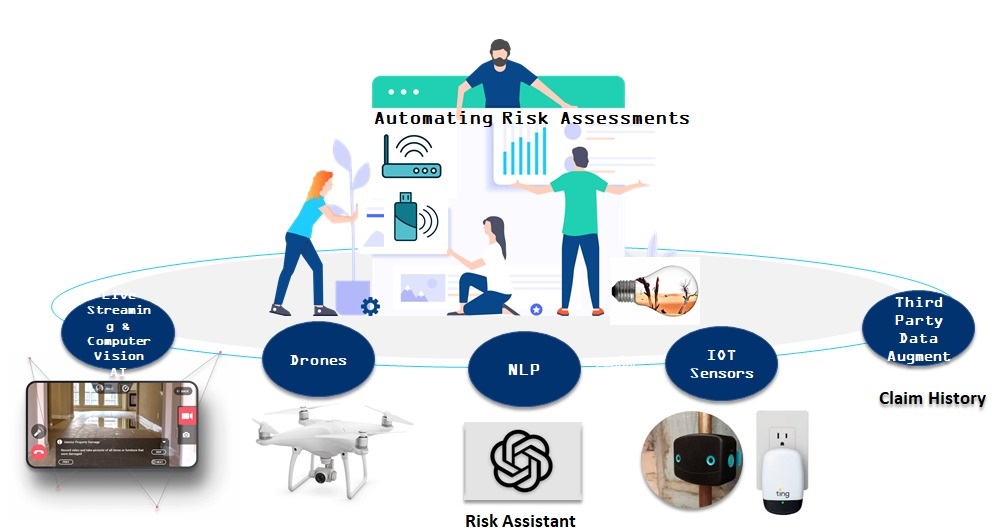

Symplfy.ai provides Remote Automated Risk Assessment helping P&C Insurers identify and manage risks better thereby Improving & simplifying Underwriting and Claims.

Symplfy’s SaaS solutions are modular and API enabled. Modules deliver remote and automated ways to capture information, assess damages, provide estimates across both the issuance and claims side of the business and across motor and commercial property vertical.

Manual Risk Assessment is the key barrier to Insurer’s profitability.

4-5 days

Turnaround times (average wait time for risk surveys)

50%

Costs (Potential cost savings in risk surveys in GCC)

1

Limited availability of skilled risk assessors (Average Number of Risk Engineer per Insurer in GCC)

30$ Bn

Fraud

80%

Unknown Risk Exposure (Of Commercial Property risks not surveyed today in GCC)

1%

Follow-ups done on risk improvements

Symplfy Risk Platform

Symplfy’s powerful AI enabled Intelligent automation suite

Computer vision AI

Proprietary Computer vision models based on images and real time video to detect, classify and analyse key risk parameters

Generative AI

Leverage LLM models to custom build chat assistants for very specialised risk assessment and management roles

IOT Sensors Data ML

IOT platform to ingest data quickly and analyse large volumes of streaming sensor data for risk assessment and prevention

symplfy.Ai Business Impact for Insurers

Improve productivity & reduce costs

Improve the assessors productivity by over 3 times

Coverage of risks and reeduce unknown risk exposures

Increase the risk assessment capacity by 8 times

Reduce delays and expedite risk assessments

Estimated to improve turnaround times of risk assessments about 10 times.

Improves transparency & ensures robust audit and governance

Documents & workflow related to risk assessments be digitized and in one platform